43+ do 401k loans affect mortgage applications

However the lender will. In fact taking out a 401 k loan can.

When Taking A Loan From Your 401 K Might Make Sense

Web For example assume your maximum loan amount is 50000 the highest outstanding balance of your 401 k loan during the previous 12 months was 35000.

. No lengthy loan applications Since youre. A 401 k loan is usually not counted in your debttoincome ratio so it wont hurt your chances of mortgage qualifying. As long as you have a vested account balance in your 401 k and if your plan permits loans you can likely be allowed to borrow against it.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Web A 401k loan shouldnt affect your mortgage applicationthough if youre concerned about it you can ask your lender whether it will be included in your DTI. Web 401 withdrawals are generally not recommended as a means to buy a house because theyre subject to steep fees and penalties that dont apply to 401 loans.

Apply Get Pre-Approved Today. 401 k loans also have no effect on your mortgage. Mortgage lenders consider 401 k.

However you should consider a few things before taking a loan from your 401 k. Web A 401k loan doesnt affect getting approved for a mortgage and your credit does not suffer for it. Web Yes 401 k loans can affect mortgage applications.

Web More than 10000. If youre taking out a 401k loan in the hopes of making your down payment. Web You can keep contributing to your 401 k while you pay the loan backan option that may not be available if you take a hardship withdrawal.

Set A Budget Know What You Can Afford. First the bad news. Web If you need to raise cash for a short-term liquidity need a 401k is one of the first places you should consider.

Ad PNC Offers A Wide Range of Mortgage Options. The good news is its still quite possible to get a mortgage even if. Serious About Finding Your Next Home.

Web Nationwide 29 of people with student loan debt said that their student loans have delayed their purchase of a home according to a 2021 report from the National Association of Realtors. Web In some cases a 401 k loan can be a good way to access short-term cash. Web The maximum amount that the plan can permit as a loan is 1 the greater of 10000 or 50 of your vested account balance or 2 50000 whichever is less.

Compare Apply Directly Online. Web Your 401 k plan may allow you to borrow from your account balance. Web Most lenders do not consider a 401k when calculating your debt-to-income ratio hence the 401k loan may not affect your approval for a mortgage loan.

See Our Comparison Site Find Out Which Lender Suits You The Best. If you take a 401 withdrawal before age 59½ youll have to pay. A 10 early withdrawal penalty on the funds removed Income tax on the amount withdrawn.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. Your student loans will affect your ability to get a mortgage. After 30 years your nest egg would be worth 235000 more assuming a 7 percent annual return.

401 k loans are not reported to credit bureaus so applying for one wont harm your credit score. Whether they affect an application in a good or a bad way will depend. Web Borrowing from your own 401 k doesnt require a credit check so it shouldnt affect your credit.

Web Does 401k contribution affect mortgage approval. Web Even if your 401 k plan allows loans theres a limit on how much you can borrow typically up to 50 of your vested balance with a maximum loan amount of. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years.

Start The Application Process Today. Taking a 401k loan can help you avoid the high-interest payday days. Even if you subtract the interest you paid on the mortgage you.

Does a loan from 401k count as debt. For example if a participant has an account balance of 40000 the maximum amount that he or she can borrow from the account is 20000. Web A 401 k loan shouldnt affect your mortgage application though if youre concerned about it you can ask your lender whether it will be included in your DTI calculation.

Ad Shortening your term could save you money over the life of your loan. Web Per standard underwriting guidelines 401K loan payments are not considered when calculating debt to income ratios therefore have little to no bearing on a mortgage. Skip The Bank Save.

Ad Compare the Best Home Loans for March 2023.

Is Borrowing Against A 401 K Counted When Buying A House Pocketsense

401 K Home Loan Rules Movement Mortgage Blog

Lawrence Journal World 10 26 11 By Lawrence Journal World Issuu

:max_bytes(150000):strip_icc()/Homebuyers-1b0481b648814dda95233db348d8f575.jpg)

Will A Loan On My 401 K Affect My Mortgage

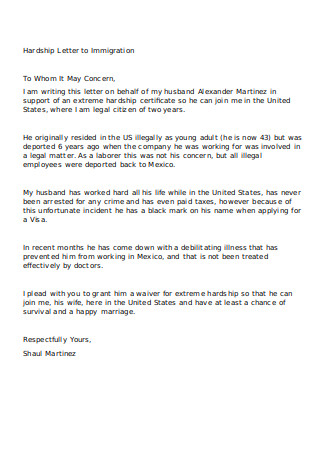

40 Sample Hardship Letters In Pdf Ms Word

Do 401 K Loans Affect Mortgage Applications Smartasset

Is Borrowing Against A 401 K Counted When Buying A House Pocketsense

Be Careful Using 401 K For A Down Payment

Special Edition Using Microsoft Office Excel 2007 Pdf Free Download

Assets To Include On Your Mortgage Application Veteran Com

Oregon Financial Services Businesses For Sale Bizbuysell

Oregon Financial Services Businesses For Sale Bizbuysell

Borrow From Your 401k To Buy A Home

Can I Use My 401 K To Buy A House 2023 Guide

Just Start Real Estate With Mike Simmons Toppodcast Com

Postal Retirement Q A 2013 Articles By Roseanne Jefferson Postalmag Com

Does A 401 K Loan Reflect On Your Debt To Income Ratio